« Computers | Main | Health Care Reform »

Sunday, October 25, 2009

Stock Market (Revisited)

Researching the stock market and individual stocks can be like a paying job. With the power of compounding, small improvements in investment returns amount to big differences over time. Comparing 25 year-long investments for example, show that if you started with $10,000 you would have earned over $14,000 more at 8% than at 7%.

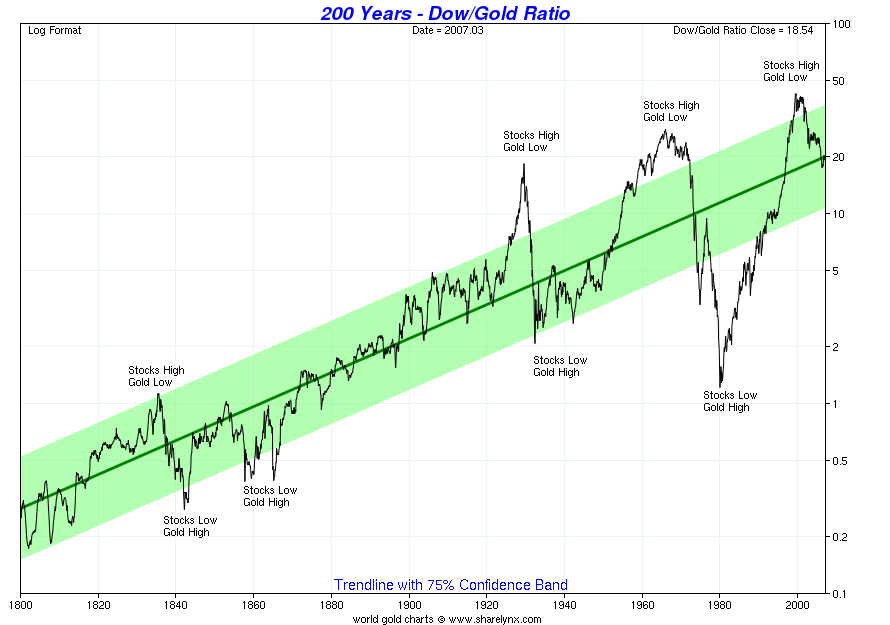

With the recent increases in gold and silver, one might wonder if precious metals are good long-term investments. Wikipedia has a chart (shown below, copyright held by www.sharelynx.com, but authorized for copy) that illustrates how the price of gold has fared versus the Dow Jones Industrial Average, a proxy for the stock market.

On examination, two observations are significant. 1) Just like in the plot of the S&P 500, shown in a previous post, the stock market's moves follow a trend over time and, 2) On average, the stock market increases 2% per year more than the value of gold.

Arguably the most significant is what isn't shown. This chart ends March 2007. Taking the value of the Dow today (9972) and dividing by the price of gold today (about $1055) yields a point at October 2009 and 9.5 - which is below the shaded 75% confidence band. In other words, stocks are low or gold is high by historical standards.